You're accustomed to money going in a certain direction, but sometimes you have to pay your customers.

There are times when you have to issue a payment to a customer QuickBooks provides forms that allow that transfer of funds: credit memos and refunds.

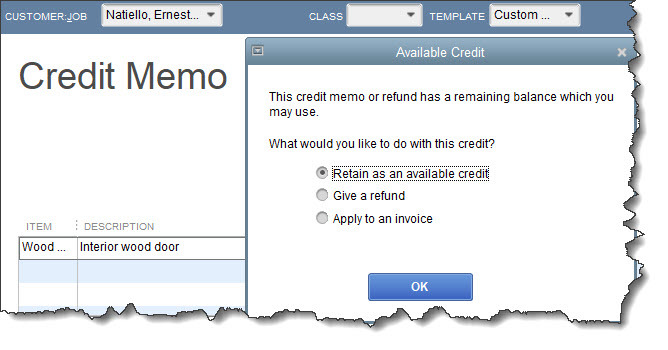

Credit Memos

- Retaining the funds in the customer account.

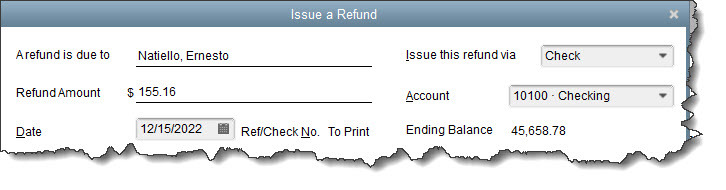

- Issuing a refund.

- Applying it to the next open invoice.

The Issue a Refund window there is an open invoice, the Apply Credit to Invoices window will open, containing a list of unpaid bills. If there isn’t already a checkmark in front of the invoice you want to apply it too, click in the first column to create one. QuickBooks will tell you how much credit was applied and whether any remains. When you’ve checked the screen for accuracy, click Done.

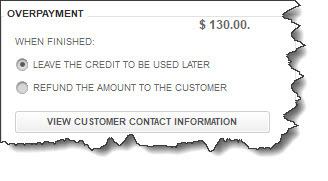

Dealing with Overpayments

Let’s say a customer is catching up on multiple outstanding invoices and he or she sends you a check for the total but overpays you. Open the Receive Payments window by going to Customers | Receive Payments or clicking Receive Payments on the home page. Select the customer and enter the Payment Amount and Check #. QuickBooks will have put a checkmark in front of all the outstanding invoices listed to indicate they’ve been paid.

In the lower left corner, you’ll see a section titled Overpayment. The extra amount and your two options for dealing with it appear here. You can either credit the customer or issue a refund. Click the action you want to take, then save the transaction.

.png)